Industrial Case Study: How a $4.6M industrial brand recovered from a failed exit to grow profit by 22%

See how a $4.6M industrial brand recovered from a failed acquisition to achieve 22% profit growth and 5.5x ROI. Learn the exact strategies that freed the founder from 50+ hours/week of operations.

Quick Summary

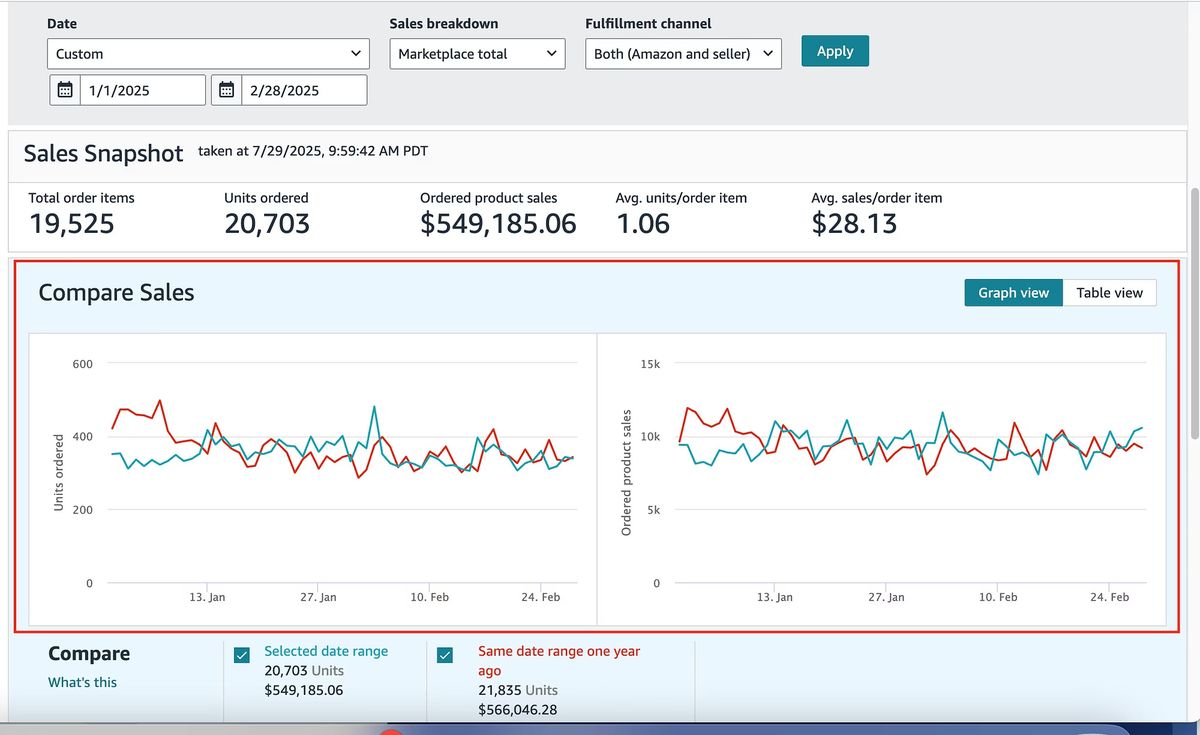

A $4.6M industrial components brand increased profit payout by 22% and achieved 5.5x ROI on engagement fees—recovering from a failed acquisition by implementing profit-first operations that freed the founder from 50+ hours/week of operational work.

Key Takeaways

- Increased profit payout by 22% (from $1.03M to $1.25M) while maintaining healthy 12% TACoS

- Achieved 5.5x ROI on engagement fees—$5.50 returned for every $1 invested

- Secured #1 Best Seller badge in US market through systematic listing optimization

- Freed founder from 50+ hours/week of operational work to focus on strategic growth

- Expanded into Canada market with 2.1% YoY revenue growth while US grew 4.3%

About the Client

Niche: Industrial & Scientific Components

Revenue: $4.6 Million

Team: Founder-led, bootstrapped

Matt began in 2015 rebuilding small-engine parts in his garage after work. What started as a one-product side hustle is now a multi-million-dollar brand with 25+ SKUs selling across the US and Canada - built entirely through his hands-on product knowledge and data-driven decision-making.

"When I interviewed Naeela, her direct, data-backed approach stood out right away - she challenges assumptions and moves faster than any agency I've worked with."

- Matt

What Went Wrong After the Failed Acquisition?

By mid-2024, Matt had just clawed his brand back after a buyer defaulted on the acquisition deal. Margins were shrinking, supply-chain costs were climbing, and growth had flattened.

"It felt like starting over - expensive, frustrating, and I was ready to escape the day-to-day."

- Exit Fallout: Lack of visibility diagnosing what the buyer changed, and what broke. Listings, pricing, and workflows were left in disarray.

- Tariff and cost pressure: New tariffs, higher storage fees, and slower AWD shipping eroded margins. Stock-outs on key SKUs limited revenue upside.

- PPC Performance Drift: Campaigns lacked strategic oversight; TACoS crept up while topline growth hovered at 1-3%. Limited visibility into ASIN-level profitability.

- Operational Overload: Founder trapped in daily ticketing and case management. Support interactions consumed hours, diverting focus from growth initiatives.

Hands-on Audit: Key Findings

We didn't just pull reports - we rolled up our sleeves and inspected every product in the catalog.

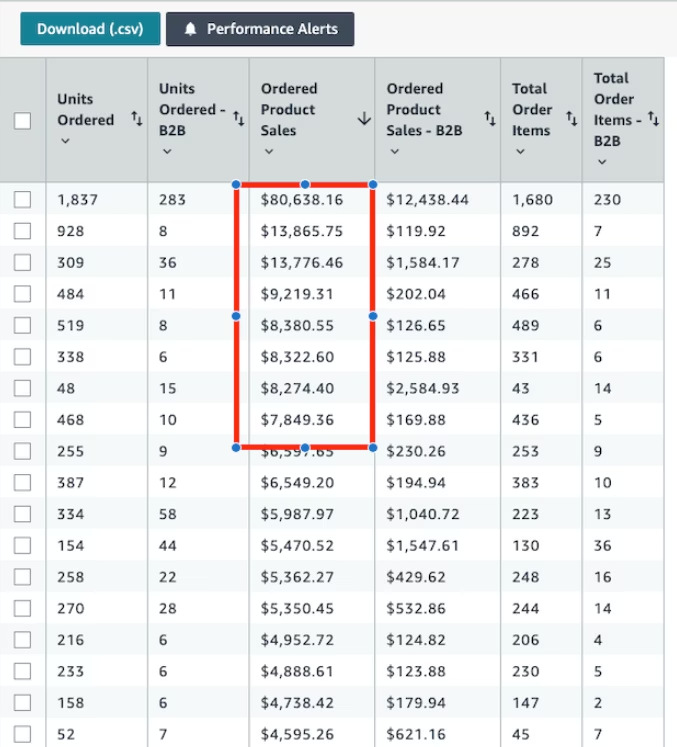

- Revenue pulse: Growth had plateaued and category rank was starting to slip.

- Wasted ad spend: A big chunk of budget wasn't moving the sales needle. Very little focus on organic ranking.

- Inventory pulse: Best-sellers faced stockouts while slow movers tied up cash.

- Conversion issue: Critical keywords and reviews were missing, capping organic reach.

- Account health: Stranded SKUs, hidden fees, and compliance red flags.

How Did ALFI Approach the Recovery?

The Profit-First Diagnosis

"When I interviewed Naeela, her direct, data-backed approach stood out right away - she challenges assumptions and moves faster than any agency I've worked with."

- Matt, Founder & CEO

- Diagnose: We deep-dived into their entire Amazon ecosystem - PPC, keywords, inventory & customer reviews - to pinpoint profit leaks and root causes.

- Tailored solution: Once we identified the problem, we crafted a profit-first roadmap - optimizing PPC bids, expanding high-value keywords and streamlining inventory.

- Fast implementation: We rolled out changes fast, tracked the numbers, and strategically managed ad-spend at the product level - so results showed up right away.

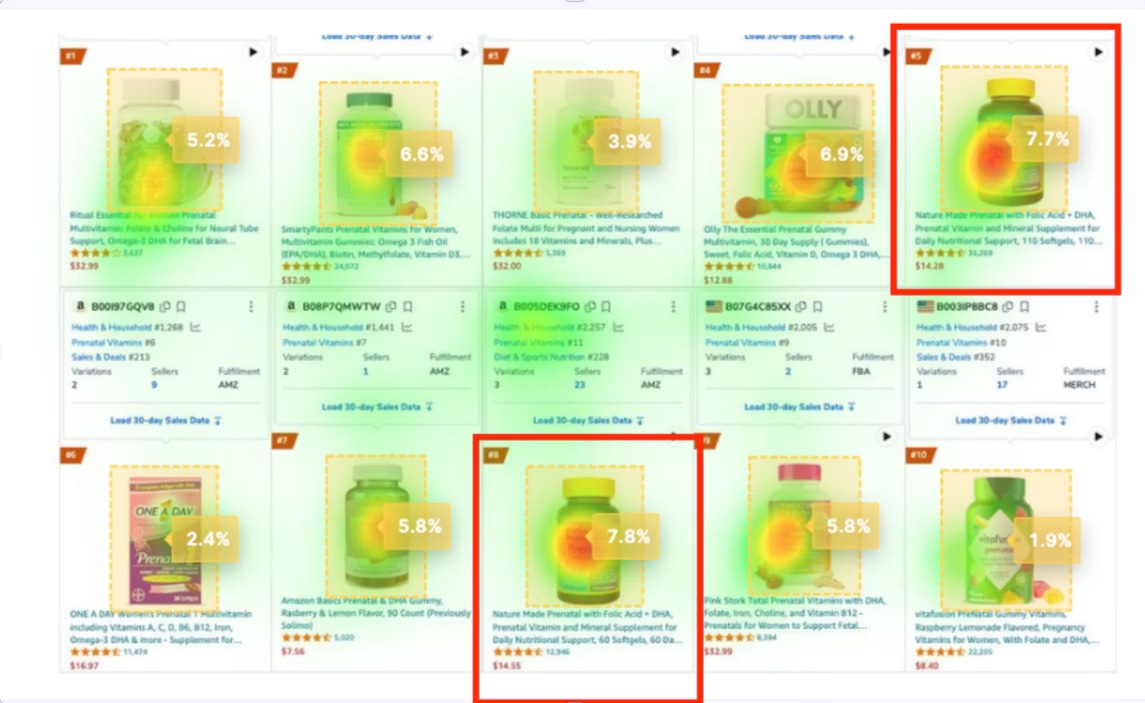

Deep Dive 1: Declining Market Share

Lost Badges, Lost Sales

Shoppers picked competitors with Amazon badges, better reviews, and Amazon's Choice. The brand lost clicks and sales.

Key Stat: Category rank slipping, conversion dropping

90-Day Action Plan: Audit, Fix & Scale

We rolled out our 90-day action plan to audit, fix, and scale.

- Audit every ASIN: Zeroed-in on the 20% of competitors & keywords taking 80% of sales. Competitor analysis, keyword, SEO, image, review, price and ranking audit on every ASIN.

- Fix the gaps: Overhauled Product Detail pages - fresh imagery, copy, A/B test images, refresh A+ content, test pricing, secure badges, plan deals on every ASIN.

- Scale what wins: Roll out bundles, promotions, and targeted ads; track performance and iterate weekly.

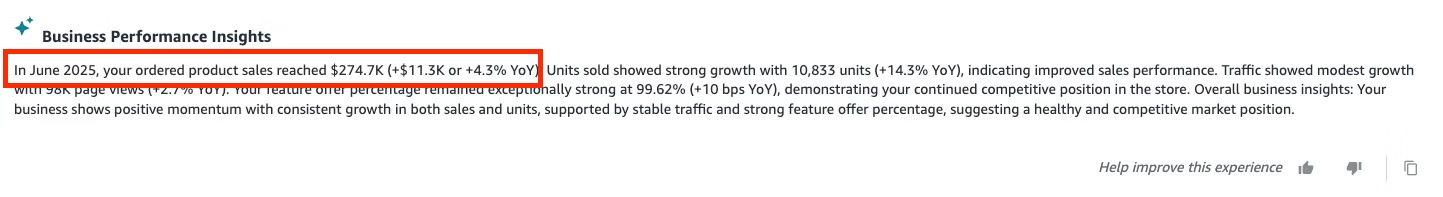

Results: +6.4% Revenue

US YoY revenue went up by 4.3%, Canada revenue went up 2.1%, confirming balanced geographic expansion. Secured both the #1 Best Seller badge (US) and Amazon's Choice badge (CA SKU).

- +4.3% - US Revenue (Year over year)

- +2.1% - Canada Revenue (Year over year)

- #1 - Best Seller Badge (Secured in US)

- 12% - TACoS (Held steady)

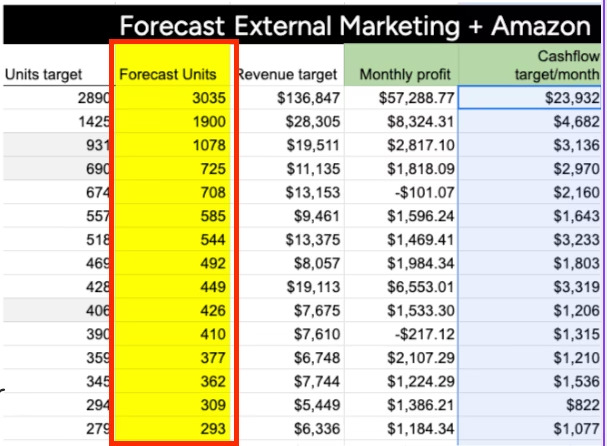

Deep Dive 2: Forecast, Cash, and Supply Chain

Bottlenecks Everywhere

Forecasting gap: The team projected demand only from past sales, causing stock and marketing budgets to fall short. Cash-flow squeeze: Amazon payouts arrived too slowly to fund faster inventory and ad spend.

Key Stat: Supplier ceiling: Vendors maxed out with 30-day lead times

90-Day Action Plan: Focus on Forecasting

Diagnosed what's blocking growth: Forecasting, Payouts, or Inventory Limits.

- Rebuild the Forecast Model: Create a rolling 12-month forecast that layers in growth targets, promotions, and seasonality; update it every month.

- Audit and Fix Cash-Flow: Map payout timing vs. inventory and ad spend, then set 14-day checkpoints to keep working capital positive.

- Secure Extra Funding: Negotiate extended supplier terms. Aim for smaller deposits and longer balances (e.g., 30% down, 70% 60 days after shipment).

- Add Supply Capacity: Share the new forecast with the primary factory and onboard a secondary supplier to cover at least 30% of volume.

- Weekly Forecast-to-Actual Reviews: Compare sales, inventory, and cash vs. plan each Friday and adjust orders, bids, or pricing before small gaps widen.

Results: +22% Profit

Revenue up 6.4% while profit payout jumped 22% - showing the profit-first focus. Canada drove two-thirds of the lift. Return on engagement: 5.5x, meaning every dollar of fees delivered $5.50 back.

- +22% - Profit Payout (From $1.03M to $1.25M)

- +6.4% - Revenue (From $2.1M to $2.2M)

- 5.5x - ROI on Engagement ($5.50 back per $1 fee)

- 0 hrs - Founder Ops Work (Down from 50+ hrs/wk)

Hidden Profit, Unlocked

Profit isn't a one-lever trick. We synced listings, ads, pricing, and operations so every piece pulled its weight.

- Profit payout +22% while keeping healthy 12% TACOS

- Revenue +6% and conversion rate climbed

- Re-structured 40%+ of campaigns, redirected budget to best-margin SKUs

- Took over all case management, catalog fixes, and AWD stock monitoring

- Implemented unified dashboard pulling Amazon, Sellerboard, and finance data for weekly decisions

Client Testimonial

"In just six months, our brand transformed from a cost center into a high-margin growth engine. I can't point to one magic move - every part of this process compounded to explode our business."

- Matt, Founder & CEO

We get in the trenches with you.

What makes us different?

No distant theories - we visit you onsite, watch you in action, and co-create solutions with you.

"With the big agencies it's like moving the Titanic, but with your group we get changes logged and live in days, not weeks."

- Matt

- Weekly 1:1 strategy sessions: Tackling real problems

- Custom feedback: Tailored to Matt's unique catalog

- Reassurance and accountability: To trust the profit-first approach

Frequently Asked Questions

How do you recover an Amazon brand after a failed acquisition?

Recovery starts with a full diagnostic of what changed during the acquisition—listings, pricing, workflows, and PPC campaigns. We then rebuild systematically: audit every ASIN, fix pricing and content gaps, restructure ad campaigns around profit targets, and implement operational processes the founder can trust.

What ROI can I expect from Amazon management services?

Results vary by brand, but this industrial brand achieved 5.5x ROI—returning $5.50 for every $1 in engagement fees. The 22% profit increase came from a combination of better ad efficiency (12% TACoS), improved conversion rates, and operational time savings worth 50+ hours per week.

How do you handle international expansion on Amazon (US and Canada)?

We treat each marketplace as its own profit center with tailored strategies. For this brand, we balanced investment between US (4.3% YoY growth) and Canada (2.1% YoY growth), ensuring neither market cannibalized the other while maintaining consistent brand positioning and inventory management.

What operational tasks does ALFI take over from founders?

We handle day-to-day Amazon operations including case management, catalog fixes, AWD stock monitoring, PPC optimization, and weekly performance reporting. This industrial brand founder went from 50+ hours/week on operations to zero, freeing him to focus on product development and strategic decisions.

How long does it take to see profit improvements after a brand recovery?

Initial improvements typically appear within 90 days. This brand saw revenue stabilize in the first quarter, with the full 22% profit improvement materializing over 6 months as we optimized across PPC, inventory forecasting, and operational efficiency.